The current global health crisis has had the biggest negative impact on gig economy workers and low-wage workers. Already vulnerable, they lack the financial resources and access to benefits that could help cushion the impact of the crisis on their livelihoods.

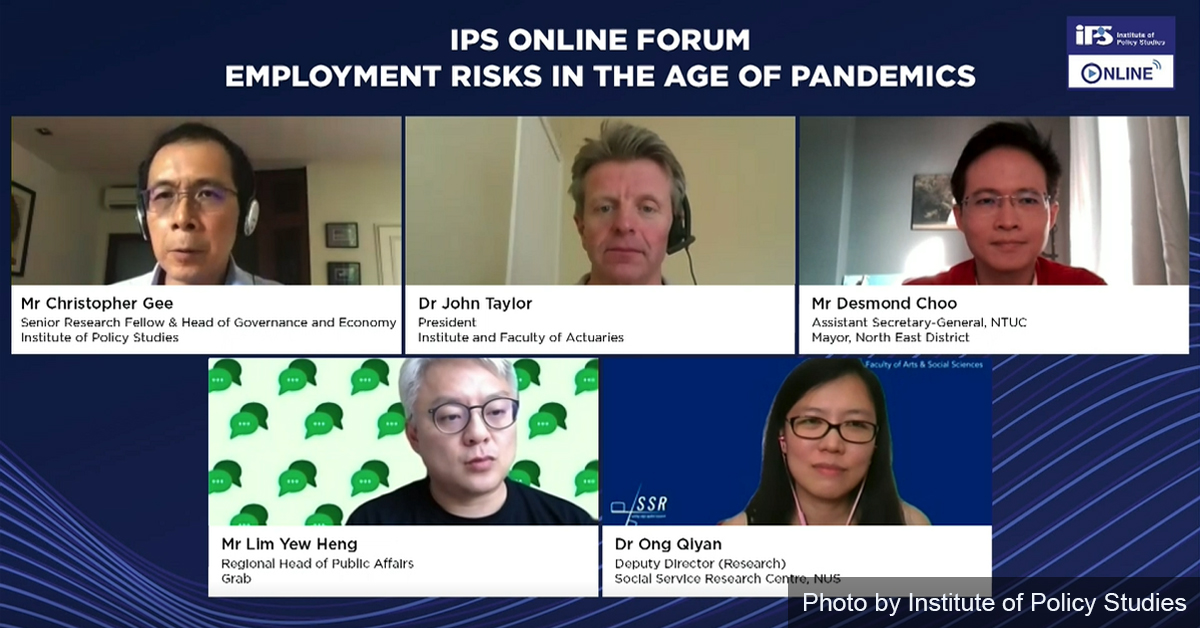

In the third session of the IPS Online Series, Mr Christopher Gee, Senior Research Fellow and Head of the Governance and Economy Department at IPS, moderated a 90-minute discussion on “Employment Risks in the Age of Pandemics” . The panellists discussed solutions that could protect such workers against loss of income and help them overcome job insecurity, even beyond the current crisis.

All four panellists agreed that structural and mindset changes are needed.

Dr John Taylor, President of the Institute and Faculty of Actuaries, detailed how, starting in the 1980s, employment risk moved from governments and employers to workers, in order to encourage individual accountability and self-reliance. Thus, people were expected to use their own funds to tailor an insurance package that suited their needs. According to Dr Taylor, this system only benefited the wealthy few, and left the bulk of individuals who could not afford to do so vulnerable to risks.

Dr Ong Qiyan, Deputy Director (Research) of the Social Service Research Centre at National University of Singapore, highlighted two segments of vulnerable workers in Singapore — the self-employed working in the gig economy, and full-time workers in what she called “triple low full-time jobs” marked by low wages, low entitlements and low bargaining power.

These workers earn little and barely have any benefits in the form of annual leave and sick leave. Even full-time workers have low bargaining power to demand and enjoy their benefits. So, despite the current pandemic, they would often choose to go to work despite the high health risk, in order to put food on the table and ensure they do not lose their jobs.

Many self-employed workers, hit by the effects of the pandemic and recognising this imbalance of power, have joined the National Trade Unions Congress (NTUC), said Mr Desmond Choo, NTUC’s Assistant Secretary-General and Mayor of North East District. He said they have come to the union to get insurance cover and legal and employment support.

However, he noted that the current Employment Act does not cover self-employed workers, which limits the extent of NTUC’s support. He called for legislative changes to bring this group into the fold, especially if its numbers are going to increase in future.

Dr Ong also suggested trade unions take on a larger role by enforcing the Employment Act and bargaining for more work flexibility and higher wages. She called for government-paid sick leave and making fair treatment one of the assessment criteria for awarding government contracts. This could help full-time workers in small companies.

Mr Gee mooted the idea of allowing people to draw down on CPF funds to tide them over this tough period, a suggestion which Mr Choo and Dr Ong did not agree with.

Mr Choo did not see value in citizens “mortgaging their future” for short-term relief. Instead, he suggested that workers focus on upskilling and companies be incentivised to train their workers. This would prevent the “erosion of human capital” and put Singapore in a better position to rebound from the crisis when the time comes.

Dr Ong, stressing the importance of reducing the number of triple-low jobs, called for a temporary universal basic income funded by higher taxes, which would nudge society as a whole to play a part in contributing to the greater good.

This same principle can also apply to companies, she added. Organisations and individuals that get help should be willing to give back in terms of taxes to fund more programmes later on. Under this scheme, there will be distortion on incentives to work or earn profits, she said.

Mr Lim Yew Heng, Regional Head of Public Affairs at Grab, said supporting self-employed workers was not only a responsibility but also made business sense for companies such as Grab, as it would ensure that their platforms remain attractive and sustainable to workers.

He suggested that companies like Grab could play a role. He cited the example of Grab Malaysia providing microinsurance to its workers, who are not well-banked and, therefore, do not have traditional access to loans or insurance. As Grab has data on its workers’ earning capabilities and risk profiles, it is better able to provide them with personal loans and insurance coverage, he added.

To this, Dr Ong questioned if Grab, given its market power, should have a role in providing social insurance to society. Mr Lim responded that while healthy cynicism and caution towards tech companies such as Grab is necessary, it does not negate the fact that 8 million users around the region rely on the platform to generate income. He reassured that Grab takes its responsibilities seriously and remains accountable to its workers and consumers.

The fact that there is no one-size-fits-all solution reflects the complexities of the issue. However, all agreed that there is a need to act immediately because the meagre bargaining power of the low-income worker will only get weaker with time.